Fitch and R&I affirmed rating with a stable outlook.

April 16th, 2025

Government Securities Auctions

See information from previous years

2025

| Quarterly Government Securities Auction Calendar | Presentation |

|---|---|

| First Quarter | |

| Second Quarter |

2024

| Quarterly Government Securities Auction Calendar | Presentation |

|---|---|

| First Quarter | |

| Second Quarter | |

| Third Quarter | |

| Fourth Quarter | |

| Amendments Fourth Quarter |

2023

| Quarterly Government Securities Auction Calendar | Presentation |

|---|---|

| First Quarter | |

| Second Quarter | |

| Third Quarter | |

| Fourth Quarter |

2022

| Quarterly Government Securities Auction Calendar | Presentation |

|---|---|

| First Quarter | |

| Second Quarter | |

| Third Quarter | |

| Fourth Quarter |

2021

| Quarterly Government Securities Auction Calendar | Presentation |

|---|---|

| First Quarter | |

| Second Quarter | |

| Third Quarter | |

| Fourth Quarter |

2020

| Quarterly Government Securities Auction Calendar | Presentation |

|---|---|

| First Quarter | |

| Amendments First Quarter | |

| Second Quarter | |

| Third Quarter | |

| Fourth Quarter |

2019

| Quarterly Government Securities Auction Calendar | Presentation |

|---|---|

| First Quarter | |

| Second Quarter | |

| Third Quarter | |

| Fourth Quarter |

2018

| Quarterly Government Securities Auction Calendar | Presentation |

|---|---|

| First Quarter | |

| Second Quarter | |

| Third Quarter | |

| Fourth Quarter |

2016

| Quarterly Government Securities Auction Calendar | Presentation |

|---|---|

| First Quarter | |

| Second Quarter | |

| Amendments Second Quarter | |

| Third Quarter |

2015

| Quarterly Government Securities Auction Calendar | Presentation |

|---|---|

| Fourth Quarter | |

| Third Quarter | |

| Second Quarter | |

| First Quarter |

2014

| Quarterly Government Securities Auction Calendar | Presentation |

|---|---|

| Fourth Quarter | |

| Third Quarter | |

| Second Quarter | |

| First Quarter |

2013

| Quarterly Government Securities Auction Calendar | Presentation |

|---|---|

| Fourth Quarter | |

| Third Quarter | |

| Second Quarter | |

| First Quarter |

2012

| Quarterly Government Securities Auction Calendar | Presentation |

|---|---|

| Fourth Quarter | |

| Third Quarter | |

| Second Quarter | |

| First Quarter |

Related Websites

Contact

![]() ori@hacienda.gob.mx

ori@hacienda.gob.mx

Victor Hugo Vázquez Cortés, General Director

Zabdiel Ruíz Ortíz, Director

![]() +52 (55) 36 88 2618 | +52 (55) 36 88 2679

+52 (55) 36 88 2618 | +52 (55) 36 88 2679

![]() 1971 Insurgentes Sur Av. (Plaza Inn), 3rd Tower, Floor 10, Guadalupe Inn, 01020, Mexico City.

1971 Insurgentes Sur Av. (Plaza Inn), 3rd Tower, Floor 10, Guadalupe Inn, 01020, Mexico City.

Frequently Asked Questions

The Investor Relations Office (IRO) of the Ministry of Finance and Public Credit (MoF) is the responsible office of releasing accurate and reliable economic data, as well as meeting the needs of analysts and investors to develop an ongoing dialogue with Mexican financial authorities. The IRO offers the following services:

- Providing periodical information on the economic environment and the situation of Mexico's public finances and public debt.

- Organizing quarterly conference calls to discuss the economic outlook, as well as the country's public finance and debt situation.

- Publishing a summary of economic programs and information related to events and/or actions of an official nature, relevant to the economic environment and/or to the evolution of public finances and debt.

- Answering questions related to financial and economic data of the public sector.

- Answering questions about economic programs and, in general, about the economic policy strategy, public finances or public debt.

- Inviting all analysts and followers of Mexico's economic environment to join its mailing list to receive timely information from the MoF.

The IRO is attached to the Economic Planning Unit, which works together with the Public Credit Unit in order to release the Federal Government’s debt and public finance management strategy:

| Unit | Goal | Head of Unit |

|---|---|---|

| Economic Planning Unit |

|

Rodrigo Mariscal Paredes |

| Public Credit Unit |

|

María del Carmen Bonilla Rodríguez |

The IRO provides the following contacts:

- If you are a media company, please contact the Communication Unit:

- Wilhem Friedrich Hagelsieb Garza | wilhem_hagelsieb@hacienda.gob.mx

- Eduardo Marín Conde | eduardo_marin@hacienda.gob.mx

- If you are a (potential) investor or represent a financial institution or international organization, please fill out the following form and send it to: ori@hacienda.gob.mx

The IRO is located at Av. Insurgentes Sur No. 1971 (Plaza Inn), Tower III, 10th Floor, Guadalupe Inn, Del. Álvaro Obregón, México City, C.P. 01020.

- Mail: ori@hacienda.gob.mx

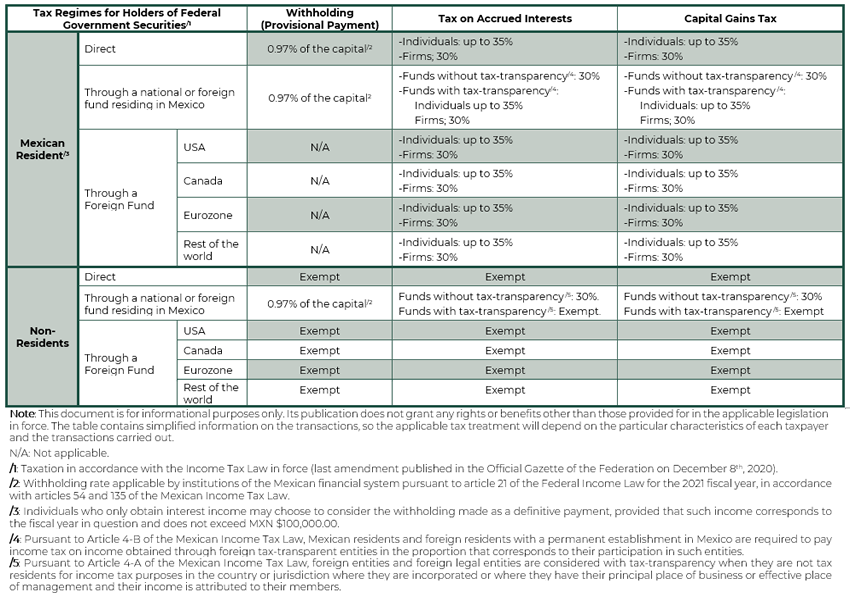

The IRO does not address questions related with payment of taxes. A brief guide to the tax regimes for holders of Federal Government securities is provided below.

For complete advice, you should contact the Tax Administration Service (SAT), a decentralized agency of the MoF whose purpose is to collect federal taxes and other items intended to cover the expenses foreseen in the Federal Expenditure Budget.

You can receive assistance by e-mail: asisnet@sat.gob.mx; or directly on its website: www.sat.gob.mx.

The IRO does not provide assistance for opening businesses or promoting products/investments in Mexico and abroad. The Ministry of Economy (MoE) is the government agency in charge of providing advice to entrepreneurs in Mexico and, in general, of the necessary procedures for commercial activities.

For further guidance, please visit the Foreign Direct Investment site of the MoE to learn more about the registration of foreign investments, the procedures manual and the legal framework for investment in Mexico.

The IRO makes available a presentation document of the Federal Government's securities as well as the the requirements to participate in the primary auctions, which can be done through a Market Maker or through another credit institution.

Bank of Mexico (Banxico), which acts as the Federal Government's financial agent, provides more detailed information regarding the auctions and placement of securities. We invite you to consult its website for more information.

Furthermore, if you would like to consult more information on outstanding government securities holdings, we invite you to consult Banco de México's database.

Public finance and public debt statistics can be consulted on the website of the Ministry of Finance:

In the Economic Information Bank of INEGI you can consult economic information as well as historical series:

Banco de México also has an Economic Information System where you can find information on the foreign exchange and securities markets, interest rates, balance of payments, among other information:

Finally, the Ministry of Economy's Data Mexico site offers a wide range of databases on trade, production, employment, education and demographics, among others, for the entire country:

For any further questions, please contact us at ori@hacienda.gob.mx

State-Owned Entreprises

Federal Government Rating

|

|

Rating |

Outlook |

Latest revision |

Rating Agency Report |

SHCP Press Release |

|

Baa2 | Negative | November-14-2024 | ||

|

BBB | Stable | December-13-2024 | ||

|

BBB- | Stable | April-16-2025 | ||

|

BBB+ | Negative | November-25-2024 | ||

|

A- | Stable | May-29-2024 | ||

|

BBB | Stable | May-07-2024 | ||

|

BBB | Stable | May-03-2024 | ||

|

BBB+ | Stable | April-16-2025 |

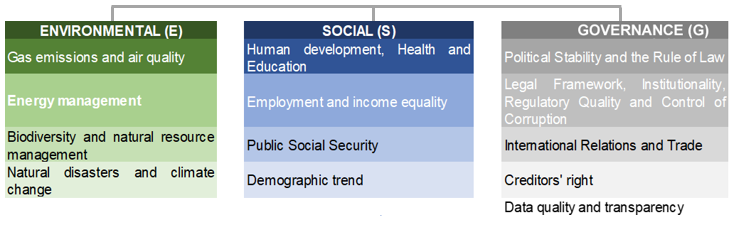

ESG and Rating Agencies

The Environmental, Social and Governance (ESG) considerations are a set of parameters that define investments with positive social impact, combined with competitive long-term financial returns.

ESG considerations are composed of the following factors:

Moody’s rating agency recently incorporated the ESG factors on Mexico's sovereign rating (Baa1). Each component scores from 5 to 1, considering 1 as a positive impact and 5 as a high negative impact.

Mexico's ESG Credit Impact Score (CIS) is moderately negative (CIS-3). This reflects the country's moderate exposure to environmental risks, balanced by higher governance and social risks without prejudice to the soundness of its macroeconomic framework. Other countries with a similar score are Chile, Paraguay, Panama, Italy, Portugal and Thailand.

-

Environmental: Mexico is exposed to risk of carbon transition in the medium and long term. Nevertheless, the size and diversity of the economy help mitigate the impact of the country's exposure to physical climate risk. Mexico's score: E-3 Moderately Negative, equal to the Netherlands (Aaa) and Chile (A1).

-

Social: Mexico faces moderate challenges in the provision and quality of basic services, and risks related to the aging of the population. Mexico's score: S-3 Moderately Negative, equal to the United States (Aaa), Hong Kong (Aa3) and Spain (Baa1).

-

Governance: The government of Mexico maintains a strong track record of effective fiscal and monetary policymaking, as well as the strength of key institutions that support macroeconomic stability. Mexico score: G-3 Moderately Negative, equal to Russia (Baa3) and Costa Rica (B2).

Fitch Ratings agency only considers the Governance criteria in the sovereign methodology as highly relevant for the credit rating of Mexico. ESG scores range from 3-5, where 3 is neutral and 5 is the most relevant.

-

Political Stability and Rights: reflects a recent history of peaceful political transitions and a moderate level of rights to participate in the political process. Mexico score: ESG-5, same as the United States (AAA) and Canada (AA +).

-

Rule of Law, Institutional & Regulatory Quality and Control of Corruption: moderate institutional capacity, an established rule of law and a moderate level of corruption. Mexico score: ESG-5, same as the United States (AAA) and Canada (AA +).

-

Human rights and Political Freedoms: Freedom of expression and accountability are a relevant factor for the sovereign rating. Mexico score: ESG-4, same as the United States (AAA) and Canada (AA +).

-

Creditor Rights : The willingness to service and repay debt is relevant to the rating. Mexico score: ESG-4, same as the United States (AAA) and Canada (AA +).

-

The ESG assessment is currently available only for the corporate sector.

Last update: Mayo 17th, 2021.

Small Investor

Through cetesdirecto® you can invest directly in government securities without the intermediation of the bank, brokerage house or other institutions. It is very simple and you can invest since 100 pesos.

Created by SHCP and operated by Nafin

![]() Advantage

Advantage

- Does not charge any commission.

- You can have your money whenever you want and without penalty.

- You can start saving from $ 100 pesos and there’s no need to maintain a minimum balance.

- You can open and operate your account in a few minutes, from the internet.

- No financial intermediaries.

- Your money keeps its value and you can have it whenever you decide.

- Risk-free investment.

- Support from the Government of Mexico.

![]() Requirements

Requirements

- Being 18 years or older.

- Being a Mexican resident.

- Having a bank account.

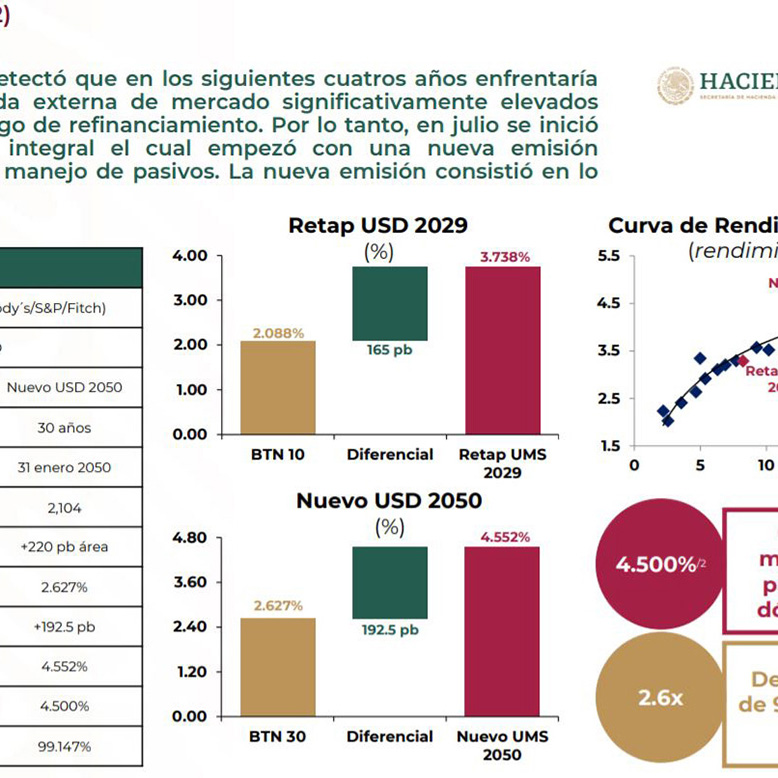

International Market Operations

Presentations

Last update: January 2021

Recent operations in the international market

Recent Operations in the Local Market

Investors’ Handouts

Debt Strategy and Financing Plan

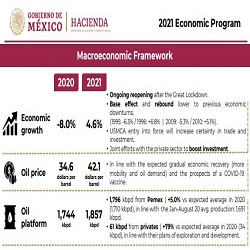

Debt Strategy Objectives for 2021

- To cover the financing needs of the Federal Government at an adequate cost and risk level, given the characteristics of the country's public finances and the prevailing market conditions.

- To improve the debt maturity profile as well as to reduce its cost and risk characteristics.

- To carry out a comprehensive management of the risks of the public debt portfolio.

- To promote the participation of the capital markets in instruments aligned to the ESG criteria (Environmental, Social and Governance).

Publication Calendar

|

Document |

Publication date |

|

Fourth Quarter Report on Public Finances and Public Debt |

January 30th, 2025 |

|

Monthly Report on Public Finances and Public Debt as of January |

February 28th, 2025 |

|

Monthly Report on Public Finances and Public Debt as of February |

March 28th, 2025 |

|

2026 Preliminary General Economic Policy Guidelines |

April 1st, 2025 |

|

First Quarter Report on Public Finances and Public Debt |

April 30th, 2025 |

|

Monthly Report on Public Finances and Public Debt as of April |

May 30th, 2025 |

|

Monthly Report on Public Finances and Public Debt as of May |

June 30th, 2025 |

|

Second Quarter Report on Public Finances and Public Debt |

July 30th, 2025 |

|

Monthly Report on Public Finances and Public Debt as of July |

August 29th, 2025 |

|

2026 Economic package:

|

September 8th, 2025 |

Public Finance and Debt Report

The Quarterly Reports include an update on the situation of the Mexican economy, the main financial and public debt results in the corresponding period.

The Monthly Reports include the main public finance and public debt results.

The Preliminary General Economic Policy Guidelines is the document in which the dialogue with the Congress of the Union about the budget process for the following fiscal year begins. The document includes the economic and public finance perspectives for the end of the current fiscal year and the following one. It also includes the estimation of the main macroeconomic variables, the priority programs and their respective desirable amounts. The Federal Executive, through the SHCP, delivers the document to the Congress of the Union no later than April 1st of every year.

The General Economic Policy Guidelines is one of the documents that make up the Economic Package for each fiscal year (together with the Income Law initiative, the Expenditure Budget Project and the Fiscal Miscellaneous). It includes an update of the international and national economic situation, the estimation of the main macroeconomic variables. These are used to formulate the estimates of public finances for the current and the following fiscal year, to establish the direction of the economic policy as well as to make medium-term projections. The Federal Executive Branch delivers the Economic Package to the Congress of the Union no later than September 8th of every year.

The Annual Borrowing Plan contains the elements of the public debt policy of the Federal Government as well as of the public entities who are recurring debt issuers.

| 2024 | Press Release | Complete document | Audio1 |

|---|---|---|---|

| Fourth Quarter | AUDIO | ||

| Third Quarter | AUDIO | ||

| Second Quarter | AUDIO | ||

| First Quarter | AUDIO |

1The audio corresponds to the conference call for investors organized after the publication of the Report.

| 2023 | Press Release | Complete document | Audio1 |

|---|---|---|---|

| Fourth Quarter | AUDIO | ||

| Third Quarter | AUDIO | ||

| Second Quarter | AUDIO | ||

| First Quarter | AUDIO |

1The audio corresponds to the conference call for investors organized after the publication of the Report.

| 2022 | Press Release | Complete document | Audio1 |

|---|---|---|---|

| Fourth Quarter | AUDIO | ||

| Third Quarter | AUDIO | ||

| Second Quarter | AUDIO | ||

| First Quarter | AUDIO |

1The audio corresponds to the conference call for investors organized after the publication of the Report.

| 2021 | Press Release | Complete document | Audio1 |

|---|---|---|---|

| Fourth Quarter | AUDIO | ||

| Third Quarter | AUDIO | ||

| Second Quarter | AUDIO | ||

| First Quarter | AUDIO |

1The audio corresponds to the conference call for investors organized after the publication of the Report.

| 2020 | Press Release | Complete document | Audio1 |

|---|---|---|---|

| Fourth Quarter | AUDIO | ||

| Third Quarter | AUDIO | ||

| Second Quarter | AUDIO | ||

| First Quarter | AUDIO |

1The audio corresponds to the conference call for investors organized after the publication of the Report.

| 2019 | Press Release | Complete document | Audio1 |

|---|---|---|---|

| Fourth Quarter | AUDIO | ||

| Third Quarter | NA | ||

| Second Quarter | AUDIO | ||

| First Quarter | AUDIO |

1The audio corresponds to the conference call for investors organized after the publication of the Report.

| 2018 | Press Release | Complete document | Audio1 |

|---|---|---|---|

| Fourth Quarter | NA | ||

| Third Quarter | NA | ||

| Second Quarter | NA | ||

| First Quarter | NA |

1The audio corresponds to the conference call for investors organized after the publication of the Report.

| 2017 | Press Release | Complete document | Audio1 |

|---|---|---|---|

| Fourth Quarter | NA | ||

| Third Quarter | NA | ||

| Second Quarter | NA | ||

| First Quarter | NA |

1The audio corresponds to the conference call for investors organized after the publication of the Report.

| 2016 | Press Release | Complete document | Audio1 |

|---|---|---|---|

| Fourth Quarter | NA | ||

| Third Quarter | NA | ||

| Second Quarter | NA | ||

| First Quarter | NA |

1The audio corresponds to the conference call for investors organized after the publication of the Report.

| 2015 | Press Release | Complete document | Audio1 |

|---|---|---|---|

| Fourth Quarter | NA | ||

| Third Quarter | NA | ||

| Second Quarter | NA | ||

| First Quarter | NA |

1The audio corresponds to the conference call for investors organized after the publication of the Report.

| 2014 | Press Release | Complete document | Audio1 |

|---|---|---|---|

| Fourth Quarter | NA | ||

| Third Quarter | NA | ||

| Second Quarter | NA | ||

| First Quarter | NA |

1The audio corresponds to the conference call for investors organized after the publication of the Report.

| 2013 | Press Release | Complete document | Audio1 |

|---|---|---|---|

| Fourth Quarter | NA | ||

| Third Quarter | NA | ||

| Second Quarter | AUDIO | ||

| First Quarter | AUDIO |

1The audio corresponds to the conference call for investors organized after the publication of the Report.

| 2012 | Press Release | Complete document | Audio1 |

|---|---|---|---|

| Fourth Quarter | AUDIO | ||

| Third Quarter | AUDIO | ||

| Second Quarter | AUDIO | ||

| First Quarter | AUDIO |

1The audio corresponds to the conference call for investors organized after the publication of the Report.

| 2011 | Press Release | Complete document | Audio1 |

|---|---|---|---|

| Fourth Quarter | AUDIO | ||

| Third Quarter | AUDIO | ||

| Second Quarter | AUDIO | ||

| First Quarter | AUDIO |

1The audio corresponds to the conference call for investors organized after the publication of the Report.

| 2010 | Press Release | Complete document | Audio1 |

|---|---|---|---|

| Fourth Quarter | AUDIO | ||

| Third Quarter | AUDIO | ||

| Second Quarter | AUDIO | ||

| First Quarter | AUDIO |

1The audio corresponds to the conference call for investors organized after the publication of the Report.

| 2009 | Press Release | Complete document | Audio1 |

|---|---|---|---|

| Fourth Quarter | AUDIO | ||

| Third Quarter | AUDIO | ||

| Second Quarter | AUDIO | ||

| First Quarter | AUDIO |

1The audio corresponds to the conference call for investors organized after the publication of the Report.

| 2008 | Press Release | Complete document | Audio1 |

|---|---|---|---|

| Fourth Quarter | AUDIO | ||

| Third Quarter | AUDIO | ||

| Second Quarter | NA | ||

| First Quarter | AUDIO |

1The audio corresponds to the conference call for investors organized after the publication of the Report.

| 2007 | Press Release | Complete document | Audio1 |

|---|---|---|---|

| Fourth Quarter | AUDIO | ||

| Third Quarter | AUDIO | ||

| Second Quarter | AUDIO | ||

| First Quarter | AUDIO |

1The audio corresponds to the conference call for investors organized after the publication of the Report.

| 2006 | Press Release | Complete document | Audio1 |

|---|---|---|---|

| Fourth Quarter | AUDIO | ||

| Third Quarter | AUDIO | ||

| Second Quarter | AUDIO | ||

| First Quarter | AUDIO |

1The audio corresponds to the conference call for investors organized after the publication of the Report.

| 2005 | Press Release | Complete document | Audio1 |

|---|---|---|---|

| Fourth Quarter | AUDIO | ||

| Third Quarter | AUDIO | ||

| Second Quarter | AUDIO | ||

| First Quarter | AUDIO |

1The audio corresponds to the conference call for investors organized after the publication of the Report.

| 2004 | Press Release | Complete document | Audio1 |

|---|---|---|---|

| Fourth Quarter | NA | ||

| Third Quarter | NA | ||

| Second Quarter | AUDIO | ||

| First Quarter | AUDIO |

1The audio corresponds to the conference call for investors organized after the publication of the Report.

| 2003 | Press Release | Complete document | Audio1 |

|---|---|---|---|

| Fourth Quarter | AUDIO | ||

| Third Quarter | AUDIO | ||

| Second Quarter | AUDIO | ||

| First Quarter | AUDIO |

1The audio corresponds to the conference call for investors organized after the publication of the Report.

| 2002 | Press Release | Complete document | Audio1 |

|---|---|---|---|

| Fourth Quarter | AUDIO |

1The audio corresponds to the conference call for investors organized after the publication of the Report.

| 2024 | Press Release | Complete document |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| 2023 | Press Release | Complete document |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| 2022 | Press Release | Complete document |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| 2021 | Press Release | Complete document |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| 2020 | Press Release | Complete document |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| 2019 | Press Release | Complete document |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| 2018 | Press Release | Complete document |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| 2017 | Press Release | Complete document |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| 2016 | Press Release | Complete document |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| 2015 | Press Release | Complete document |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| 2014 | Press Release | Complete document |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| 2013 | Press Release | Complete document |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| 2012 | Press Release | Complete document |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| 2011 | Press Release | Complete document |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| 2010 | Press Release | Complete document |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| 2009 | Press Release | Complete document |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| 2008 | Press Release | Complete document |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| 2007 | Press Release | Complete document |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| 2006 | Press Release | Complete document |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| 2005 | Press Release | Complete document |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| 2004 | Press Release | Complete document |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| 2003 | Press Release | Complete document |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| Year | Press Release | Document |

|---|---|---|

| 2018 | NA |

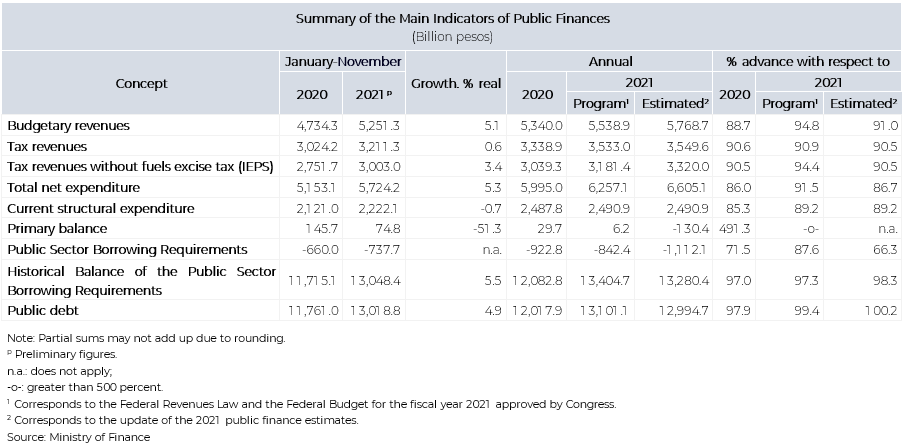

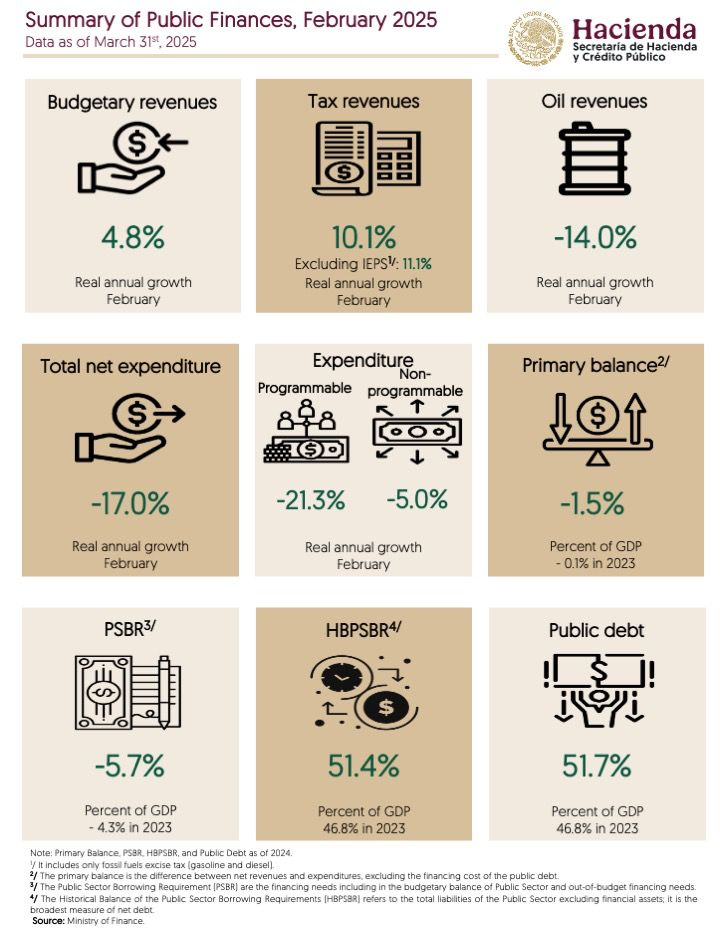

Summary of Public Finances

Federal Government Security Holdings

Government Securities Holdings by Sector

% of the total

Foreign Holdings by Federal Government Domestic Securities

MXN Billion

Last update: April 4th with data as of March 25th, 2025.

Source: Bank of Mexico.

External Debt of the Federal Government

Holdings of External Debt

Maturity Profiles

Last update: November 5th with data as of October 31st 2024.

Main Macroeconomic Indicators of Mexico

Last update: April-29-2025 at 2:30 p.m. (Mexico City time)

Domestic Debt of the Federal Government

Domestic Debt by Instrument

Maturity Profiles

Last update: November 5th with data as of October 31st 2024.

Public Sector Debt

Historical Balance of the Public Sector Borrowing Requirements

Public Sector Borrowing Requirements

| 2023e | 2024e | Change in percentage points | |||

|---|---|---|---|---|---|

| Issuer | billion pesos | % GDP | billion pesos | % GDP | |

| Total | 4,867 | 15.2 | 5,583 | 16.2 | 1.0 |

| Federal Government | 3,636 | 11.4 | 4,251 | 12.4 | 1 |

| Development Banks | 607 | 1.9 | 897 | 2.6 | 0.7 |

| SOEs1 | 307 | 1.0 | 52 | 0.2 | -0.8 |

| Other Issuers2 | 318 | 1.0 | 384 | 1.1 | 0.1 |

bn: billion pesos.

1 State-Owned Enterprises: Pemex and CFE.

2 FIRA, FONACOT and IPAB.

Source: July 5th with data as of May 27td 2024.

e: Year End Estimate.

Gross Debt of the Federal Government

Technical Notes

Subscribe to our newsletter to receive latest news and our technical notes.

Historical Recent News

Recent News

Investor Relations Office of the Ministry of Finance and Public Credit

The Investor Relations Office (IRO) is in charge of promoting the dialogue between analysts, investors, and the authorities of the Ministry of Finance and Public Credit (SHCP).

On this website you can find information on Mexico's economic outlook, public finances and public debt.

Additionally, in the Debt Operations section you can find all the relevant information regarding the Federal government securities, conditions to participate in our auctions, the auction calendar as well as lists of market makers.

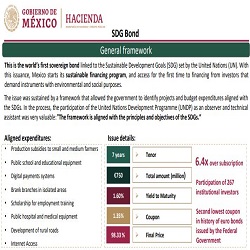

Sustainables Sovereigns Bonds

After committing to the 2030 Agenda, Mexico has shown a clear commitment to advance towards the United Nations Sustainable Development Goals (SDGs). The necessary institutional architecture has been developed through the creation of the National Council for the 2030 Agenda and the Specialized Technical Committee on Sustainable Development Goals. In addition, the Ministry of Finance has been incorporating a sustainability approach to the budget process by linking resources to reducing national lags in the different SDGs.

The commitment of the Ministry of Finance with sustainability has led to the development of the Framework of Reference for Sovereign Bonds consistent with the SDGs, which seeks to promote sustainable financing and respond to the growing demand of investors for instruments with social and environmental impact.

Market Makers

In Mexico, Market Makers are credit institutions and brokerage houses, appointed by the Ministry of Finance and Public Credit, whose mandate is to actively participate in the fixed-rate securities market.

These institutions are obliged to present bids at competitive prices in each of the primary auctions of these securities, as well as to permanently quote purchase and sale prices in the secondary market in order to provide liquidity and facilitate investment in this market.

For more information related to the Market Makers program see:

- Circular 5/2011 | Applicable procedures for market makers

- Circular 7/2011 | Procedures to exercise the right to purchase

In this section, the institutions appointed to participate in auctions of Bonds and Udibonos are presented on a monthly basis.

| Programa de Subastas de Valores Gubernamentales | Presentación |

|---|---|

| Primer Trimestre |

| Programa de Subastas de Valores Gubernamentales | Presentación |

|---|---|

| Primer Trimestre | |

| Modificaciones Primer Trimestre | |

| Segunda Modificación Primer Trimestre | |

| Segundo Trimestre | |

| Tercer Trimestre | |

| Cuarto Trimestre |

| Programa de Subastas de Valores Gubernamentales | Presentación |

|---|---|

| Primer Trimestre | |

| Segundo Trimestre | |

| Tercer Trimestre | |

| Cuarto Trimestre |

| Programa de Subastas de Valores Gubernamentales | Presentación |

|---|---|

| Primer Trimestre | |

| Segundo Trimestre | |

| Tercer Trimestre | |

| Cuarto Trimestre | |

| Modificaciones Cuarto Trimestre |

| Programa de Subastas de Valores Gubernamentales | Presentación |

|---|---|

| Primer Trimestre | |

| Segundo Trimestre | |

| Tercer Trimestre | |

| Cuarto Trimestre |

| Programa de Subastas de Valores Gubernamentales | Presentación |

|---|---|

| Primer Trimestre | |

| Segundo Trimestre | |

| Modificaciones Segundo Trimestre (Uso de Remanente) | |

| Tercer Trimestre | |

| Cuarto Trimestre | |

| Modificaciones Cuarto Trimestre |

| Programa de Subastas de Valores Gubernamentales | Presentación |

|---|---|

| Cuarto Trimestre | |

| Tercer Trimestre | |

| Segundo Trimestre | |

| Primer Trimestre |

| Programa de Subastas de Valores Gubernamentales | Presentación |

|---|---|

| Cuarto Trimestre | |

| Tercer Trimestre | |

| Segundo Trimestre | |

| Primer Trimestre |

| Programa de Subastas de Valores Gubernamentales | Presentación |

|---|---|

| Cuarto Trimestre | |

| Tercer Trimestre | |

| Segundo Trimestre | |

| Primer Trimestre |

| Programa de Subastas de Valores Gubernamentales | Presentación |

|---|---|

| Cuarto Trimestre | |

| Tercer Trimestre | |

| Segundo Trimestre | |

| Primer Trimestre |

| Programa de Subastas de Valores Gubernamentales | Presentación |

|---|---|

| Cuarto Trimestre | |

| Tercer Trimestre | |

| Segundo Trimestre | |

| Primer Trimestre |

| Programa de Subastas de Valores Gubernamentales | Presentación |

|---|---|

| Cuarto Trimestre | |

| Tercer Trimestre | |

| Segundo Trimestre | |

| Primer Trimestre |

| Programa de Subastas de Valores Gubernamentales | Presentación |

|---|---|

| Cuarto Trimestre | |

| Tercer Trimestre | |

| Segundo Trimestre | |

| Primer Trimestre |

| Programa de Subastas de Valores Gubernamentales | Presentación |

|---|---|

| Cuarto Trimestre | |

| Tercer Trimestre | |

| Segundo Trimestre | |

| Primer Trimestre |

| Programa de Subastas de Valores Gubernamentales | Presentación |

|---|---|

| Cuarto Trimestre | |

| Tercer Trimestre | |

| Segundo Trimestre | |

| Primer Trimestre |

| Programa de Subastas de Valores Gubernamentales | Presentación |

|---|---|

| Cuarto Trimestre | |

| Tercer Trimestre | |

| Segundo Trimestre | |

| Primer Trimestre |

| Market Makers and Aspirants | Bonds | Udibonos |

|---|---|---|

| April | ||

| March | ||

| February | ||

| January |

| Market Makers and Aspirants | Bonds | Udibonos |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| Market Makers and Aspirants | Bonds | Udibonos |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| Market Makers and Aspirants | Bonds | Udibonos |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| Market Makers and Aspirants | Bonds | Udibonos |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| Market Makers and Aspirants | Bonds | Udibonos |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| Market Makers and Aspirants | Bonds | Udibonos |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March | ||

| February | ||

| January |

| Market Makers and Aspirants | Bonds | Udibonos |

|---|---|---|

| December | ||

| November | ||

| October | ||

| September | ||

| August | ||

| July | ||

| June | ||

| May | ||

| April | ||

| March |